Proof perhaps that sometimes even a humble blog post can have some impact, it appears that we have had some movement on the question of the ECB’s secret letter to Ireland. Some further comments here.

Category Archives: Central Banks

The ECB’s Secret Letter to Ireland: Some Questions

By announcing it is only willing to purchase Spanish and Italian government bonds if these governments apply for funding from the EFSF bailout fund, the ECB is now exerting pressure on these countries to sign full bailout agreements. Officially,Mario Dragih’s position on how the ECB engages with governments (as explained at his June press conference) is

I do not view it as the ECB’s task to push governments into doing something. It is really their own decision as to whether they want to access the EFSF or not.

In reality, the record of the ECB’s role in Ireland’s bailout application (admittedly at the time under the leadership of Draghi’s predecessor) suggests it is an organization that is not at all averse to pushing governments into bailout funds. As the facts below illustrate, this record also doesn’t provide encouragement that the ECB will act in an open and transparent manner when doing so.

In the months leading up to Ireland’s bailout agreement, the ECB had become increasingly concerned about the amount of money it was loaning to Irish banks. In early November, it appears the ECB decided it needed to intervene.

On Friday November 12, 2010, Reuters reported that Ireland was in talks with the EU to receive emergency funding. The Irish government denied that any official talks were taking place. However, Brian Lenihan, Ireland’s Minister for Finance at the time, subsequently told a BBC documentary that, on this same day he received a letter from Jean-Claude Trichet advising him that Ireland should enter an EU-IMF program. Lenihan was adamant that “the major force of pressure for a bailout came from the ECB”.

The Irish Times has reported that

Dublin officials believed the letter to be forthright, with an implicit threat that support for Ireland’s banks was at risk.

Alan Ahearne, Lenihan’s economic adviser at the time, confirmed these reports to the Irish Independent:

“Yeah, the letter came in on the Friday from Trichet. The ECB were getting very hostile about the amount of money that it was having to lend to Ireland’s banks. The ECB demanded something be done about it and it mentioned Ireland going into the bailout. They were keen to get Ireland into the programme.”

He added: “Lenihan rang Trichet that day, and they agreed officials would meet the following day in Brussels. When they met, the ECB put huge pressure on Ireland to go into the programme.”

Ahearne said Lenihan was now at the centre of international chaos and Ireland’s future hung in the balance.

“The following Tuesday, Lenihan went to the eurozone meeting …”

The Independent story does not state the date of arrival of Trichet’s letter but the reference to a Eurozone meeting on the following Tuesday confirms November 12 as the date.

Within weeks of the receipt of this letter, Ireland had entered an EU-IMF financial assistance programme. Given the key role the ECB letter of November 12 appears to have played in such an important event in Europe’s economic history, one might hope that this letter would now be in the public domain. However, the letter has not been released.

Last December, an Irish journalist, Gavin Sheridan requested that the ECB provide him with “any and all communications from the ECB addressed to the Irish finance minister (or his direct office) in the month of November 2010”.

The ECB responded by supplying one letter dated November 18 (a technical communication relating to payments systems) but refused to supply another letter that dated November 19 (one week after the Reuters story and one day after Central Bank of Ireland Governor Patrick Honohan conceded that a bailout deal was likely).

The ECB’s justifications for not releasing the letter included the following paragraph:

The second letter, dated 19 November 2010, is a strictly confidential communication between the ECB President and the Irish Minister of Finance and concerns measures addressing the extraordinarily severe and difficult situation of the Irish financial sector and their repercussions on the integrity of the euro area monetary policy and the stability of the Irish financial sector.

The content of the letter was alluded to as follows:

The ECB must be in a position to convey pertinent and candid messages to European and national authorities in the manner judged to be the most effective to serve the public interest as regards the fulfilment of its mandate. If required and in the best interest of the public also effective informal and confidential communication must be possible and should not be undermined by the prospect of publicity. In this case, the confidential communication was aimed at discussing measures conducive to protecting the effectiveness and integrity of the ECB’s monetary policy and fostering an environment that ultimately contribute to restoring confidence among investors in the overall solvency and sustainability of the Irish financial sector and markets, which, in turn, is of overriding importance for the smooth conduct of monetary policy.

These communications raise a number of questions:

- Did the ECB communicate with Brian Lenihan on November 12, 2010? If so, why was this letter not referred to in response to Mr. Sheridan’s request?

- Did the ECB threaten to withdraw funding from Irish banks unless Ireland entered an EU-IMF program, either in a letter dated November 12 or in meetings the following weekend?

- What are the contents of the November 19 letter and why is this letter considered so sensitive given that it was clear to all after Governor Honohan’s remarks on November 18 that a bailout deal was being concluded?

I believe the Irish and wider European public deserve a better explanation of the events of November 2010 from the ECB. The public release of all communications from Mr. Trichet to Minister Lenihan should be part of this explanation.

Is the ECB Risking Insolvency? Does it Matter?

After Mario Draghi’s hints that the ECB is getting ready to purchase large quantities of Spanish and Italian bonds, expect to read lots of commentary claiming “the ECB is taking huge risks with its balance sheet”, that “the ECB risks becoming insolvent, endangering the future of the euro” or that “Eurozone states may have to recapitalize the ECB at huge cost to taxpayers”.

Much of this commentary is based on misunderstanding the facts about the Eurosystem’s balance sheet and the meaning of central bank balance sheets. In this post, I want to briefly explain what a central bank balance sheet is, then go through the basic facts about the capital position of the Eurosystem of central banks and then argue that the common focus on central bank solvency is misplaced.

Central Bank Balance Sheets

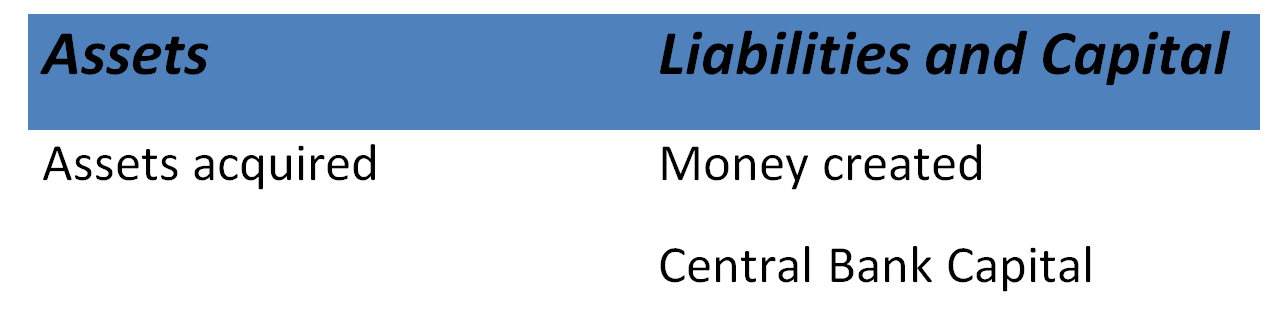

Like all businesses, central banks publish balance sheets that show their assets and liabilities. However, central banks are not just any business. They have the power to print money that is accepted as legal tender. So their assets have been acquired via printing of money. Central banks list the money they have created as liabilities and the gap between the current value of their assets and liabilities is labelled “capital”.

So a stylized central bank balance sheet looks as follows.

If a central bank purchases assets that then decline in value, it could end up having negative capital. When a commercial bank has negative capital, it is termed insolvent and either re-capitalised or shut down. The “insolvent” terminology is sometimes applied to a central bank in this situation but, as I discuss below, central banks are unique organizations and this phrase isn’t particularly appropriate.

Bond-Buying Risk: Eurosystem not ECB

A common confusion that arises when people discuss potential losses stemming from sovereign bond purchases or loans to banks comes from the assumption that the risk of these operations lies with the European Central Bank. For example, it is common to see commentary that examines the ECB’s balance sheet and concludes that the ECB faces a significant risk of becoming insolvent. This is because the ECB lists “Capital and Reserves” of only €6.5 billion, a tiny amount relative to the likely scale of bond purchases likely to be executed under the Securities Market Programme (SMP).

In fact, the ECB also has revaluation accounts and provisions, both of which can cover losses, worth €30 billion. More importantly, the risks associated with the bond-buying program are in fact shared across the ECB and all of the national central banks in the Eurosystem. So what matters when thinking about the threat to solvency of the SMP is the size of the Eurosystem’s capital resources.

The ECB releases a Eurosystem financial statement every week. Currently, it shows capital and reserves of €86 billion and revaluation reserves of €409 billion. These figures show the Eurosystem would have to incur much larger losses on its bond purchases than is often believed before the question of insolvency would become an issue.

Would Eurosystem Insolvency Matter?

This still raises an interesting question. What would happen if the ECB published its weekly balance sheet one day and it showed negative capital? For many commentators, the answer is apocalyptic. The euro will have lost all credibility as currency, hyper-inflation will ensue, that kind of thing.

In truth, the answer is that not much at all would happen. The euro is a fiat currency. In other words, unlike the days of the gold standard, the Eurosystem does not promise to swap the euro at some specified rate for another asset such as gold. The currency is not “backed” by the central bank’s assets.

Since central bank money costs next to nothing to create, the “Liabilities” on its balance sheet are essentially notional. Indeed, a central bank’s asset holdings could fall below the value of the money it has issued – the balance sheet could show it to be “insolvent” – without impacting on the value of the currency in circulation. A fiat currency’s value, its real purchasing power, is determined by how much money has been supplied and the various factors influencing money demand, not by the stock of central bank assets.

Taken to an extreme, one could argue that a central bank with sufficiently negative capital could face problems implementing monetary policy because its stock of assets may be so low as to limit its ability to sell assets to reduce the supply of privately circulating money. However, detailed analytical research by ECB economists Ulrich Bindseil, Andres Manzanares and Benedict Weller concludes that

central bank capital still does not seem to matter for monetary policy implementation, in essence because negative levels of capital do not represent any threat to the central bank being able to pay for whatever costs it has. Although losses may easily accumulate over a long period of time and lead to a huge negative capital, no reason emerges why this could affect the central bank’s ability to control interest rates.

Despite the absence of reasons to be concerned about negative central bank capital, it is still unlikely that such an outcome would be allowed to continue in the Eurozone. The actual rules relating to central bank solvency seem a bit murky but it is generally understood that any element of the Eurosystem that had negative capital would need to be recapitalized by governments providing them with assets.

Even then, these “recapitalizing” transactions wouldn’t actually have any effect on the net asset position of Eurozone governments because central banks hand over their profits to the government. For example, suppose a government hands its central bank a bond that pays €500 million in interest each year. That raises the net income of the central bank by €500 million and thus raises the amount that is handed back to the government by €500 million. The bond has no net cost to the government.

By these comments, I’m not suggesting that bond purchase programs have no cost. To the extent that they involve increasing the money supply, they can contribute to inflation so there is an implicit cost for all citizens. But this is the reason central banks need to be careful with their purchases; concerns about central bank solvency are beside the point.

Unfortunately, despite its lack of substantive importance, the idea that the Eurosystem needs to be protected from balance sheet insolvency has featured heavily in discussions of policy options. Indeed, it is well known that senior ECB officials are extremely concerned with protecting their balance sheet and have employed their “risk control framework” to protect themselves from losses at many of the key moments in the euro crisis.

One can only hope that the policy debate about the upcoming bond purchases focuses on things that matter, like the future of the euro, and not on things that don’t, like the ECB’s capital levels.

ECB : We’ll Do What It Takes. Kinda. Sorta. Later.

My thoughts on today’s ECB Governing Council announcements are here.

The Secret Tool Draghi Uses to Run Europe

Everyone knows central banks are powerful. When I used to visit Alan Greenspan’s office back when I worked for the Fed, he had a sign that said “The buck starts here.” As powerful tools go, there’s nothing that quite beats the power to print money.

So it goes without saying that ECB President Mario Draghi is powerful. He decides how much money is printed in Europe and what the cost of borrowing that money will be. But dig deeper and you’ll find that the ECB exerts far more control over events in Europe than the Fed does in the US.

For example, the ECB played a key role in the downfall of Italian Prime Minister Silvio Berlusconi. Since 2010, the ECB has had a program in which it can buy government bonds to help lower a country’s cost of funding. When Italy’s bond yields rose to dangerously high levels in August 2011, the ECB intervened to buy Italian bonds but also sent a letter to Berlusconi demanding budget cuts and far-reaching reforms. When Berlusconi failed to act with sufficient haste, the ECB eased off on its bond purchases, yields rose again to dangerously high levels and Berlusconi was forced to quit.

More obscure than the bond-buying program but far more powerful is the little-known “risk control framework”. Normally, the ECB is willing to provide loans to banks as long as they can pledge assets that are listed on its “eligible collateral list”. However, the risk control framework allows the ECB to deny credit to any bank or reject any assets as collateral should it see fit. Specifically:

the Eurosystem may suspend or exclude counterparties’ access to monetary policy instruments on the grounds of prudence

and

the Eurosystem may also reject assets, limit the use of assets or apply supplementary haircuts to assets submitted as collateral in Eurosystem credit operations by specific counterparties.

The ECB has used the risk-control framework to control events at a number of key junctures in the euro crisis.

Ireland: In late 2010, the Irish banks were under severe stress. With international depositors pulling their money out, the banks became heavily dependent on the ECB for funding. The Irish government has sufficient cash on hand to finance the country for about nine more months and was not seeking funds from the EU or IMF. The ECB, however, was unhappy with the banking situation and decided Ireland should apply for program funds to sort out the banks. So, after clearing their throats by revising the risk control framework with Ireland in mind, the framework was put to devastating use. Faced with ECB threats to withdraw funding and thus trigger a full-scale banking meltdown, Ireland quickly agreed to enter an EU-IMF program.

Spain: By late May of this year, it had become clear to all that Spain’s banks needed substantial recapitalization, starting with Bankia, a recently-created conglomerate of a number of cajas. The Spanish government decided that its preferred method for recapitalizing Bankia was to directly provide it with Spanish government bonds. This approach is perfectly legal and would have been approved by Spain’s banking regulators. However, the ECB didn’t like this approach and effectively vetoed it. What gave it such a power of veto? The risk control framework. ECB could simply threaten to refuse credit to Bankia thus triggering the type of crisis the recapitalization plans were attempting to avoid. Since Spain could not raise the sums involved, this decision effectively forced Spain to apply to the EU for aid with recapitalising its banks.

Leveraging the EFSF\ESM: Perhaps the most powerful suggestion for easing the sovereign debt crisis has been Daniel Gros and Thomas Meyer’s proposal to provide Europe’s bailout funds with a banking licence, thus allowing them to borrow from the ECB. This ESM bank could potentially purchase trillions of euros worth of government bonds and its existence would provide Italy and Spain with the kind of “bond buyer of last resort” that the Fed has provided for the US government and the Bank of England has provided for the UK government.

However, this plan currently stands little chance of getting off the ground because the ECB opposes it. Now you might argue that the EU can go ahead and give its bailout funds a banking licence anyway and indeed they could do just that. But, by now, you know the tool that Mister Draghi can use to undermine this plan: The risk control framework. The ECB can simply refuse to accept the ESM bank as an “eligible counterparty”.

All told, the story of ECB’s serial use of its risk control framework raises pretty serious questions about whether it is has been a good idea for Europe to provide this much power to a single unaccountable institution.

Ireland Debt Negotiations: Not About Interest Rate on Promissory Note

The byzantine complexities of the IBRC’s promissory note-emergency liquidity assistance arrangements are such that it is inevitable that even the smartest of people will get confused. Unfortunately, Irish Times reporter Arthur Beesley (who does excellent work covering Brussels) came a cropper in this morning’s article on the negotations over restructuring Ireland’s bank-related debt.

Arthur’s article discusses the issues as follows:

On the table is the provision of about €30 billion in bonds from a European bailout fund to the former Anglo Irish Bank to replace expensive State-funded promissory notes …

The release of European bonds to the former Anglo would be in addition to the €40.2 billion Ireland is receiving from European sources under the original bailout agreement.

This is one element of the package which would certainly necessitate parliamentary votes in a number of countries.

The key issue in this part of the negotiation is the rate of interest which would be charged on any bonds from the temporary European Financial Stability Facility or its successor, the ESM.

The basic idea is that the Government would remain on the hook for EFSF or ESM bonds given to the former Anglo but that the annual interest rate charged would be far lower than the 8.2 per cent which applies now.

Precisely what rate would be charged remains subject to negotiation, the official said.

Under present arrangements the State would pay €16.8 billion in interest by 2031, bringing the total cost of the Anglo note scheme to €47.4 billion.

This description misses the key issues at stake here in a number of ways.

The problem with the promissory note arrangement is not that it causes the state to incur high interest costs. In fact, the opposite is the case. The 8.2 percent interest rate quoted here relates to interest payments that the state is making to IBRC, a state-owned institution. This is one arm of the state paying another so the interest rate has no impact on the state’s underlying debt situation.

In the same way, the IBRC uses its promissory note payments to repay its ELA debts to the Central Bank of Ireland (another arm of the state) and the (lower) interest rate it pays on ELA also has no relevance. The Central Bank returns the profits it makes on these ELA loans to the state (see its 2011 annual report).

What is the interest cost to the state of the current arrangement? As I described in detail in this paper, the Central Bank takes in the principal payments on ELA and then retires the money that it created when granting the ELA in the first place. This reduces the balance sheet item “Intra-Eurosystem Liabilities” which the Bank currently pays 0.75% percent on.

So the effective interest rate to the state of the promissory note arrangement is 0.75%, not 8.2%. The problem with the current arrangement is not the interest rate but rather the schedule for repayment of the principal, which will see a punishing 2 percent of GDP paid over each year over the next ten years.

The article mentions a figure for the total cost of the promissory notes of €47.4 billion. However, because most of the interest cost is returned to the state, the true net cost is far lower. Effectively, the total cost will be the €31 billion in principal on the notes that were issued plus the cumulated interest costs calculated at the ECB refinancing rate. This will be far less than €47.4 billion.

In relation to substance, the article suggests the negotiations are focused on replacing the promissory notes with bonds from the EFSF and or ESM, which could then be repo’d with the ECB allowing most of the ELA borrowings to be paid off. The state would then provide EFSF\ESM with the funds to cover the annual interest on the bonds with funds.

One version of this arrangement could see the bonds pay out €30 billion in 2042, with the Irish state providing the principal to EFSF\ESM and IBRC finally repaying the ECB. A more likely scenario would see a gradual repayment of the principal via repayment of ECB and retirement of the EFSF bonds.

If these bonds are placed directly rather than borrowed from the market, then one could argue that they should carry an interest rate of close to zero, since the EFSF is no longer adding a profit margin to its cost of funds (and the cost in this case is zero).

An arrangement of this type could mimic the low interest cost to the state of the current arrangements while adding a long-term schedule for repayment of principal. However, it carries with it some serious political complications. As the Times article notes, this arrangement would require political approval throughout Europe and that may be difficult obtain. In addition, this debt would have to be repaid even if Ireland left the euro because of its official status, while a post-euro Central Bank of Ireland would have the option of agreeing to a unilateral restructuring of the promissory notes.

An alternative arrangement that avoids these political risks is to simply alter the current arrangements to have the promissory note schedule be far more back-loaded than at present. This requires only the agreement of the ECB. As I wrote here a few weeks ago, there is a strong argument that it is time the ECB could Ireland some slack.

International Money and Banking

Lecture notes for the University College Dublin module International Money and Banking (ECON30150) which was taught by Professor Karl Whelan in Autumn 2023.

Lecture Notes

0. Introduction

1. Banks and Financial Intermediation

6. Incentive Problems in Banking and the Need for Regulation

7. Micro-Prudential Banking Regulation

8. Macro-Prudential Banking Regulation

10. Monetarism

11. How Central Banks Set Interest Rates: The Federal Reserve

12. How Central Banks Set Interest Rates: The ECB

14. Default Risk and Collateral, Quantitative Easing

15. The Phillips Curve: Evidence and Implications

16. Real Interest Rates and the Taylor Rule

17. Exchange Rate Regimes and the Euro

18. The Euro Crisis

ECB Makes Crucial Policy Change on Bank Bailouts

The Wall Street Journal is reporting that the ECB has changed its position on the need to protect all senior bond holders at European banks. My current thoughts here. I will write more later about the implications of this development for Ireland.

New Briefing Paper: Ireland and the ECB

I have written a new briefing paper for the European Parliament’s Economic and Monetary Affairs committee. The paper discusses the ECB’s role in Ireland’s financial assistance programme. Here’s the abstract:

This paper reviews the role the ECB has played in financial assistances programmes in the Euro area, focusing in particular on Ireland. The ECB’s involvement in Ireland—in particular its policy in relation to senior bank debt—has raised questions about whether it has over-stretched to act beyond its mandate. The ECB is not providing official assistance to the Irish government and its involvement in monitoring the programme has confused the public about the nature of the programme’s conditionality and contributed to undermining its legitimacy. I recommend that future financial assistance programmes should not feature the ECB as a member of a Troika tasked with monitoring the programme. The ECB’s relationships with other crisis countries are reviewed. I conclude that Europe needs to clarify its policies on bank resolution and systemic risk—and the role of the ECB in relation to these policies—before it is too late.

The other briefing papers (some more on the ECB’s role in financial adjustment programmes and others on the response of central banks around the world to the crisis) can be found here. Click on 09.07.2012.

Memo to Draghi: Dead Central Banks Don’t Have Credibility

Mario Draghi today effectively ruled out the idea of ESM getting a banking license. I think this was a very bad move on his part. Article on Forbes.com here.