I attended a conference on “Financial stability policies in a changing lending landscape” at the Central Bank of Ireland on December 5. I was a discussant for an excellent paper “The state-dependent impact of changes in bank capital requirements” by Jan Hannes Lang of the ECB and Dominik Menno of the Bundesbank. In my comments, I endorsed the paper’s message that higher bank capital requirements need not be costly to the economy if implemented in a careful way. I then went a bit further and suggested these costs may be even lower than suggested in the paper, while bringing considerable financial stability benefits.

Comments on “Distinctive Features of the Irish Banking Crisis” by Patrick Honohan”

A few weeks ago, I was a discussant for a very interesting paper by Patrick Honohan reviewing Ireland’s banking crisis. My comments are here.

New Teaching Material

Prior to the Covid pandemic, I always posted my teaching materials on this website. For various reasons, I switched to using our “learning management system” Brightspace in recent years. However, I have now posted all the lecture notes for the two modules that I taught this term.

On the UK’s Fiscal Black Hole

This Thursday, the UK government will introduce a budget with significant tax increases and spending cuts. The UK press are largely reporting this as necessary to close a “black hole” in the UK’s public finances. It is frequently suggested that much of this black hole is a direct result of the fiscal profligacy proposed by the short-lived Truss government. The reporting generally suggests that a contractionary budget is a matter of common sense—books need to be balanced and after September’s chaotic events, the new government needs to demonstrate to financial markets that it is serious about fiscal discipline.

I disagree with this assessment. In fact, with the UK economy clearly tipping into recession, a large fiscal contraction is not common sense. It is certainly not what textbook macroeconomics would call for. Here, I discuss a few different aspects of the UK’s fiscal black hole, question whether austerity is necessary and point to one concrete alternative to spending cuts and tax increases as a way to reduce much of the projected budget deficit over the next few years.

It’s a long post so let me tell you how it is structured.

First, I describe what the UK’s fiscal “black hole” actually is and how it results from a series of essentially arbitrary fiscal targets rather than from a genuine crisis that must be urgently addressed.

Second, I argue against the widely promoted idea that the Truss-Kwarteng interlude showed that financial markets need to see a big fiscal adjustment now and that there would be further disruptions if we don’t see a harsh austerity programme on Thursday.

Third, I discuss two technical issues relating to the Bank of England which have had a significant influence on the current fiscal policy situation. The first is a change in the treatment of the Bank of England’s balance sheet in the government’s fiscal targets which has had a big influence on why there has been such a swift move towards austerity. The second is the Bank’s policy on paying interest on reserves to commercial banks which provides an example of an alternative policy available to the tax increases and spending cuts being implemented.

What is the UK’s Fiscal Black Hole?

The so-called black hole stems from set of fiscal targets that the UK government has set itself and which are measured and monitored by the Office for Budget Responsibility (OBR). As of now, the principal targets are that the current budget (excluding capital spending) be balanced by the third year of the OBR’s forecast and that a measure of net debt as a share of GDP be declining in the third year.

Of these two targets, the net debt target is likely to be the more binding now because it includes debt generated by capital spending and because the OBR’s forecast is going to include a decline in GDP due to the upcoming recession, thus raising the debt ratio. The Resolution Foundation have a detailed pre-budget presentation which points to the net debt rule as the key likely driver of the size of the consolidation.

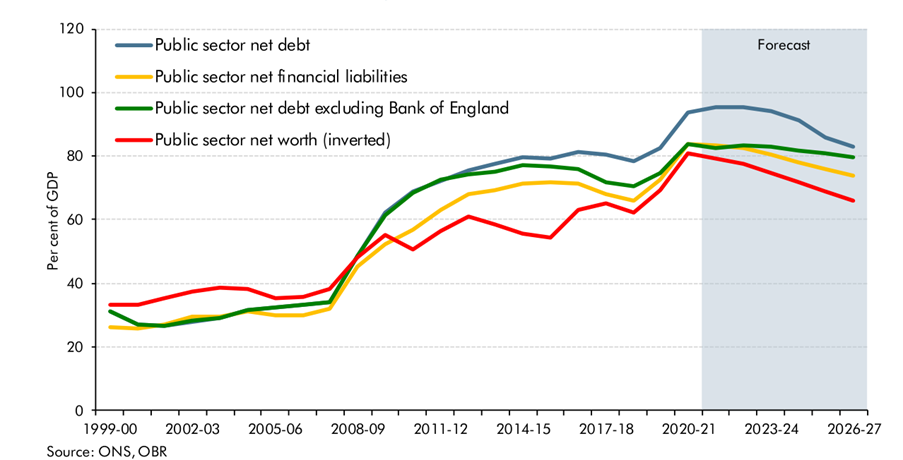

The most recent forecasts from the OBR for the net debt to GDP ratio are from March. Their March forecasts for various measures of the net debt to GDP ratios are shown below. Since late 2021, the measure chosen by the government for its target has been “public sector net debt excluding Bank of England”, the green line below. You can see that as of March, the projection for this series was that it would be flat to slightly declining in the coming years, just about in compliance with the rule.

Since March, several factors have worsened the fiscal outlook. The Bank of England has raised interest rates, increasing the cost of servicing public debt. The projected recession will reduce forecasted tax revenues and raise welfare spending and the government’s energy package will be expensive. Given all this, it is expected that without adjustments in the upcoming budget, the target measure of net debt to GDP will move upwards over the coming three years. This is the “black hole”: It is the amount of spending cuts or tax increases required to get this net debt to GDP measure falling in the third year of the forecast instead of increasing.

To many, the idea of having rules to ensure sound fiscal policy may seem sensible. However, there is little agreement among economists about the form such rules should take or indeed whether fiscal rules are a good idea at all. The UK has had various fiscal rules since 1997 and it is not clear they have been particularly helpful. A 2021 survey of macroeconomists by the LSE Centre for Macroeconomics showed about half believed fiscal rules had harmed the UK’s economic performance and nearly one-third favoured scrapping fiscal rules altogether.

One problem is that the specific rules being followed are essentially arbitrary, either relying on special “magic numbers” for debt or deficit levels (3% and 60% ring a bell for anyone?) or specific horizons over which certain objectives should be met. The UK’s current fiscal rules are new, having been announced in the 2021 budget. These new rules changed the debt target from total public sector net debt (the blue line above) to the measure excluding the Bank of England, which showed a lower net debt level. The rules were also changed from requiring a reduction in the net debt as a share of GDP over the next year to having it fall by the third year of the OBR’s forecasts. On their own, these were both sensible changes but (as I will discuss below) the change in net debt definition turned out to have unintended consequences.

So that’s the black hole. It is not in any way a pressing matter in which the UK is on the brink of “running out of money”. It is a consequence of an arbitrary rule the government has imposed upon itself with its specific form having been set just over a year ago. Had the UK government set a longer time horizon for the net debt ratio to be falling or used a different definition of the net debt ratio, the black hole would be smaller or perhaps non-existent.

Rather than sensible macroeconomics, deciding to impose a large fiscal contraction right as the economy is heading into recession runs counter to conventional macroeconomic wisdom. While the Truss-Kwarteng “let it rip now” approach to fiscal policy was clearly badly timed given current inflationary conditions, the alternative of swinging towards a big fiscal contraction to be implemented as the economy enters recession is also inappropriate. UK fiscal policy should be neutral for now but the normal approach of allowing “automatic stabilisers” to accommodate increases in welfare spending and reductions in tax revenues should operate once the economy goes into recession.

As a sign of how this austerity is badly timed, it is being widely reported that the OBR will calculate the contractionary effects on GDP of the upcoming fiscal austerity, which will worsen the projected recession and further increase the net debt to GDP ratio thus widening the so-called black hole. A chunk of this hole is being dug by the austerity itself.

But What About Markets?

What about the idea that austerity is needed to satisfy financial markets, the so-called bond market vigilantes? For many, the moral of the Truss-Kwarteng experiment was that markets require fiscal discipline and a failure to balance budgets raises the cost of borrowing and further worsens the public finances. I think this is a misinterpretation of what happened in September.

Without doubt, September’s financial market events in the UK were extraordinary but much of the turmoil related to forced selling of gilts by pension funds. While dramatic, these events were due to short-term “market plumbing” issues and were resolved fairly quickly. Beyond these short-term stresses, the key substantive macroeconomic problem was that Truss and Kwarteng introduced a set of fiscal policies that would have stimulated the economy right at the time when the Bank of England was acting to cool the economy to bring inflation down.

For some, there was also a concern that the Truss government would undermine the independence of the Bank of England and thus that higher inflation would be implicitly tolerated over the medium-term. These concerns will have required additional inflation-related compensation for investors in UK government bonds.

With Truss deposed and most (but not all) of Kwarteng’s tax cuts reversed, investors are no longer concerned that UK fiscal policy will exacerbate the current inflation problem or that the government will undermine the Bank of England’s independence. UK bond yields are up since the summer but not by much more than in other countries, all of which are also facing a persistent inflation problem and going through a monetary tightening.

Are the markets now baying for a return of austerity? I don’t think so. There was no sense prior to the Kwarteng fiscal measures that financial markets were requiring a large fiscal contraction to be willing to hold the UK’s debt and those measures have now been reversed. Also, there is nothing especially high or worrisome about current or projected levels of UK public debt. The UK gross government debt to GDP ratio for this year is about 100%, close to the average for the euro area and well below the 112% in countries like France, where nobody is claiming that financial markets are demanding austerity.

Of course, if Jeremy Hunt were to announce a much smaller austerity package than expected on Thursday, perhaps by adopting a new looser set of fiscal rules, it is possible that markets could react badly and raise long-term bond yields. However, I think a neutral budget that neither adds to the current inflation nor worsens the upcoming recession would be accepted by markets as a reasonable fiscal Ying to the Bank of England’s contractionary Yang.

The Strange Tale of the Bank of England’s Phantom Debt

One of the stranger aspects of the current turn towards austerity is the influence of a technical change in the chosen debt target. In the EU, debt targets are framed in terms of gross government debt and assets owned by governments are not considered. The EU rules also do not incorporate central banks, keeping their assets and liabilities “off balance sheet.” Until last year, the UK government’s chosen debt target differed from the EU’s approach both by subtracting off some assets and thus being a measure of “net debt” and also by incorporating the balance sheet of Bank of England.

This approach could have produced sensible net debt measures but the actual implementation did not. The Bank of England’s balance sheet shows its assets and liabilities. Its principal liabilities are the reserve accounts that commercial banks maintain with the Bank. The Bank acquired its QE portfolio and made loans to commercial banks via making credits to these accounts. These reserve accounts are liabilities for the Bank because it has a policy of paying interest on reserves. The Bank publishes its balance sheet weekly but a more accessible version is available in its 2022 annual report, which shows its February 2022 balance sheet.

The balance sheet shows that the Bank’s assets slightly exceed its liabilities. In fact, its true net position is better than this. Its balance sheet includes £86 billion in sterling bank notes in circulation that both the Bank and OBR count as liabilities. Since these are perpetual zero-interest notes, they have no cost to the Bank and so the Bank effectively has assets that well exceed its genuine liabilities. The key point here is The Bank of England has no net debt.

Despite this, the OBR made two decisions when constructing its net debt measure that meant incorporating the Bank of England’s balance sheet produced higher rather than lower net debt figures. First, the OBR decided to not include the assets the Bank acquired under its Term Funding Scheme (TFS), which loaned money to banks, while at the same time OBR decided to include the reserves that were created by the TFS loans as liabilities. OBR did this because they decided to only include liquid assets when “netting off” assets against liabilities and they decided the TFS loans were not liquid.

I don’t know why OBR considered the TFS loans to not be liquid. The Bank would never need to sell these assets so it’s an “angels on pins” discussion anyway but the loans are fully collateralised, so I’m sure the Bank could sell them fairly easily if it ever decided to do so. Anyway, in reality, the TFS scheme did not have any negative effect on the net debt of the Bank of England or the wider public sector but the OBR decided to measure it as though it did.

Second, the OBR measures the Bank’s gilt holdings acquired via QE at their face value while measuring the reserve liabilities created at the market value of the bonds purchased. Bond yields and prices move inversely, so the decline in yields during the Bank’s QE programme meant they bought bonds for market prices that were above the face value. For almost all of the post-QE purchases, the yields on the gilts purchased were higher than the interest on reserves, meaning it made profits on these investments but the OBR decided to make these transactions look like they made the Bank on net worse off.

In terms of the mechanics of how QE affected the public finances, the Bank passed most of the interest payments on its gilts back to the government, so effectively the QE programme refinanced UK government debt at the low interest rate paid on reserves and this saved the public sector money. Again, however, the OBR accounting made it look like a programme that increased UK net indebtedness.

Ultimately, central banks that print their own currency and can create money at the touch of a button are a source of revenue for governments. If your accounting says this part of the public sector has a negative net asset value, you’re doing something wrong.

Taken together, the OBR’s two dubious measurement decisions meant the incorporation of the Bank of England added a large amount of “phantom debt” to the OBR’s net debt measure. For 2021/22, the total net debt is estimated to be 95.5% of GDP while the net debt excluding the Bank of England is 82.5% of GDP. But (and this bit is important ….) the two key drivers of the phantom net debt—the TFS and the QE holdings—are projected to wind down in the coming years, so the phantom net debt declines from 13% of GDP in 2021/22 to only 3% in 2026/27.

Given how bad the OBR’s methods for incorporating the Bank of England are, the Treasury were clearly correct to switch from “net debt” to “net debt excluding the Bank of England”. The OBR itself has effectively admitted the new measure is better, saying in their March report that this change “removes the uneven effects across years caused in particular by the TFS”.

Now one might imagine that changing to this new measure would have caused there to be less pressure to introduce austerity. The new measure both makes more sense and shows lower net debt levels. However, as Rob Calvert Jump and Jo Michell have noted, this is not how things work in the world of UK fiscal rules. The new measures have increased the need for austerity.

Imagine the scenes at the Treasury after the new, better, net debt measure has been adopted.

Normal Person: “Hey look we’ve got a new measure of net debt that excludes all the phantom debt previously included by the OBR. Surely this means we don’t have to worry quite so much about debt now?”

Fiscal Rules Guy: “Well no, actually we need to worry more about debt than before. We need more spending cuts and tax increases”

Normal Person: “Why?”

Fiscal Rules Guy: “Well the new measure of net debt is lower but it doesn’t fall anymore over the next few years like the old measure did, so we need austerity.”

Normal Person: “But the old measure only fell because the non-existent phantom debt declined. Are we really introducing austerity because we stopped counting the non-existent debt?”

Fiscal Rules Guy: “Rules are rules dear fellow.”

Suffice to say 10% of GDP is a lot of spending to cut or taxes to raise over the next few years and this measurement change as a rationale for a bunch of extra austerity doesn’t fit well with common sense.

Interest on Reserves

The other way the Bank of England impacts the budget is that the Bank pays interest on reserves at its “Bank rate.” With the Bank raising interest rates, these additional payments to commercial banks will reduce the profits of the Bank of England. As a result, the Bank will go from passing profits on to the Exchequer to not doing so and, if the Bank makes losses, it may be years before it returns to passing on a dividend to the Treasury. Effectively, the Bank’s payments of interest on reserves represent a one-for-one fiscal cost for the public sector.

The payment of interest on reserves is a modern phenomenon. The Bank of England started paying interest on reserves in 2006, so there is no long tradition of banks receiving compensation on their reserves. This changed with the introduction of QE by the world’s central banks.

Prior to QE, central banks had raised interest rates by engineering a shortage of reserves, so that banks were willing to pay high interest rates to borrow funds from each other. After QE, there was no shortage of reserves, so central banks had to find another way to raise interest rates, if this was what monetary policy called for. They did this by paying interest on reserves. A bank that received a 4% interest rate just for keeping money with the central bank would not be willing to make loans at lower rates than this, so the interest rate paid on reserves became the floor for market interest rates.

When interest on reserves was first introduced, there weren’t many discussions of its fiscal impact these are now significant. For example, as of November 2nd, UK banks had £950 billion in reserve balances. If the Bank of England were to compensate those reserves at a 4% interest rate, this would imply interest payments of £38 billion per year.

Are these payments required to implement the higher interest rates the Bank wants for its monetary policy? No. It is widely understood in central banking that what is required is only that the marginal reserves in the system are paid the interest on reserves. The government doesn’t need to compensate all the reserves a bank holds. It just requires that the marginal pound of reserves that a bank holds would receive this compensation. This “tiering” approach has been used by both the Bank of Japan and the ECB, albeit in the context of negative interest rates, so that only some of the reserves that banks held with them were subject to the negative rates. But the logic that it was the marginal reserves that mattered for market rates worked perfectly.

The idea that central banks do not need to compensate all reserves may not have been discussed much in the context of the “black hole” but it is hardly a radical and dangerous idea. Former Bank of England Deputy Governor, Sir Paul Tucker, a pillar of the international central banking establishment, has proposed tiering in a recent paper, arguing the fiscal savings could be £30 billion and £45 billion over the next two budgetary years. These are large figures and would account for a big fraction of the tax increases and spending cuts being considered.

Some argue that failing to pay interest on reserves amounts to a tax on the banking sector. I don’t think this is correct. Taxes are deducted from income earned or wealth held and this policy does neither of these things. Banks holding an asset that doesn’t receive any compensation may reduce their profits but central banks have long adopted policies that either boost or reduce bank profits and these have never been labelled fiscal policies. At the end of the day, however, if the failure to compensate all reserves means bank shareholders lose money or depositors earn a lower interest rate on deposits, then there are strong arguments that these outcomes would represent a fairer way to stabilise public finances than the other options being considered.

Rather than argue that introducing tiering would be the Bank of England stepping into fiscal policy, I would describe this issue in a different way. Interest on reserves is a monetary policy. It was introduced to allow central banks to set specific levels of market interest rates and thus meet their inflation target goals. However, central banks are public bodies and there is no public policy case for central banks to spend public money if it does not actually help the central bank meet its specified objectives. Because compensating only reserves above a specific level works to allow central banks to meet their monetary policy objectives, there is no monetary policy rationale for compensating all reserves. In other words, deciding to pay interest on all reserves is the Bank of England stepping into fiscal policy, rather than sticking to its monetary policy mandate.

There Are Alternatives

It has been a whirlwind few weeks and there are several compelling moral narratives that have convinced many that the UK needs to implement an extremely harsh budget. Covid and energy packages surely must be paid for. The sins of Truss and Kwarteng’s profligacy surely must be atoned for. Sensible fiscal rules surely must be obeyed. The costs of Brexit must surely be finally faced up to. And the Bank of England’s independence surely rules out any discussion of its policies being altered because of their fiscal implications.

The reality, however, is that the UK’s public debt position is in the middle of the international pack and there are almost no discussions in other countries with similar debt levels of the need for a new round of austerity. And if the UK government wants to reduce its fiscal deficit, it is reasonable to ask whether payments that benefit bank shareholders and depositors should be protected while cuts are made to public services that are already threadbare.

Coda: Since I wrote this yesterday, I have read these (much shorter) pieces by Giles Wilkes and Duncan Weldon that cover some similar ground. (Hat tip to Stephen Bush’s excellent Inside Politics newsletter.) I think I agree more with Duncan than Giles but both are worth a read if you’ve made it this far.

#ItsNotUCDItsTheGovernment

The students union at my university are staging a protest tomorrow against the university’s management. It being Valentine’s day, the campaign features a broken heart and a slogan #ItsNotMeItsUCD. Other tweets in the campaign complain about how UCD has become a “commercialised university”, use the hashtag #NotaBusiness and contain dark murmerings about “corporate interests”. The campaign wants action from UCD management on a number of issues.

I fully understand student unhappiness with campus rents being high, with campus services not being better and various other ways in which UCD has sought to either raise income or reduce costs. I have no role in the management of the university and I don’t wish to defend the management for every decision they have taken but … I think this campaign completely misses the actual source of these problems which is the massive reduction in government funding provided to Irish universities.

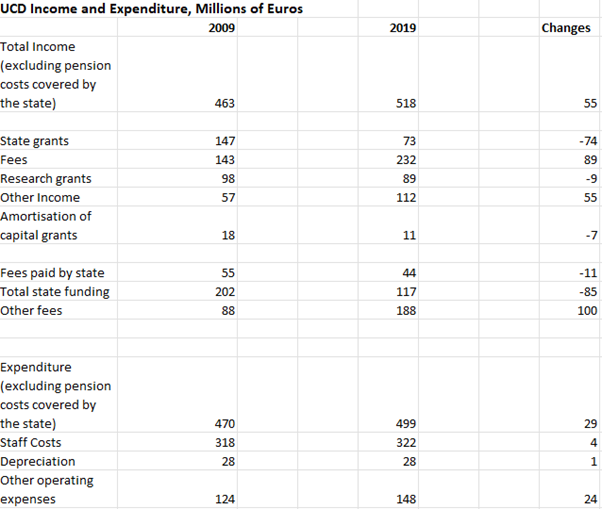

The table below shows comparable estimates of income and expenditure by UCD comparing 2019 with 2009 (the last accounts published are for 2020 but that was a strange year for the university’s finances so I’ve used 2019 instead). The figures come from here.

A few items are worth highlighting.

- UCD is not a profit-making business. It has no shareholders or “corporate interests” to pay dividends to. The money the university earns gets spent on paying for staff and services and keeping the university operating. In other tables in the financial reports you can see that there is no large endowment of money to pay for things. The university generally keeps enough cash on hand to run the university for a few months but no more than that.

- Total state funding for UCD from fees and grants fell by €85 million between 2009 and 2019, even as the economy recovered and government coffers flowed over. The state took away about 20% of the cost of funding UCD during the recession and did not return this funding when the economy improved.

- Despite this, UCD increased spending over this period with most of the additional spending going on “other operating expenses”. Spending on student facilities increased from €3 million in 2009 to €4.8 million in 2019.

- The additional spending was possible because the university increased fees from other sources by €100 million and because they raised an additional €55 million from other sources. The largest part of the increase in fee income came from Irish undergraduates having to pay a €3000 fee (a policy introduced by the government to cover much of the cost of reduced state funding) but the university also raised a lot of additional fees from non-EU students. €19 million of the increase in other income came from rents from student residences.

The bottom line in terms of what happened to Irish universities over the last decade is that the Irish government effectively walked away from funding them properly and told the universities to go raise their own income to pay for the provision of third level education.

The SU want UCD to earn less income from rents and fees and to spend more on student services and staff salaries. I’d love all of that to happen but the reality is that, as things stand, this would open a huge gap between UCD’s income and expenditure and the funding to allow that is not there. The only way there can be a large increase in spending and a corresponding reduction in income is if UCD were to get back some of the state funding that was taken away.

There is a long tradition of student unions protesting against their own university and, in many cases, they pick good causes and help to improve the world. In this case, I’m afraid UCD SU have picked the right cause but the wrong target. Ironically, this protest comes at a time when there appears to be some debates within the Cabinet about providing better funding for the university sector. Those in government who don’t want to provide more money for universities or to cut fees will be relieved that tomorrow’s protest is focused at UCD’s management rather than the Department of Higher Education or the Department of Public Expenditure.

The reality is that in the absence of a serious change in state funding, there will be no improvements in the areas the SU cares about. And blaming UCD management won’t help them come up with a magic money tree that allows more spending with lower income.

Are Central Banks Storing Up a Future Fiscal Problem?

In the past week, I’ve come across two different pieces (one by the BIS and one by the UK’s Office for Budget Responsibility) warning that the maturity of public debt in advanced economies has been shortening and this could have fiscal implications during a recovery.

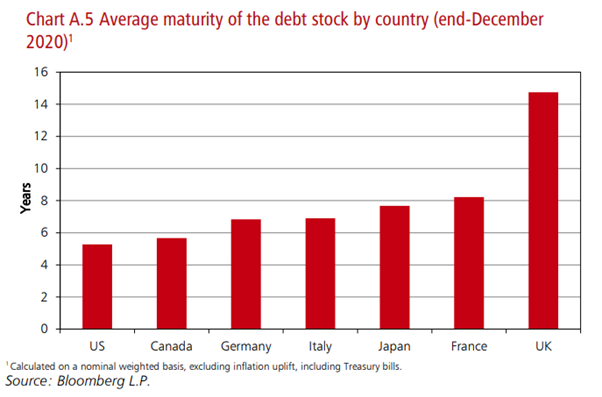

This warning might seem surprising since the Covid crisis and the low long-term interest rates of recent years have seen governments issue lots of long-term debt. Indeed, conventional measures of average public debt maturity are increasing. In the euro area, the average maturity of public debt has increased from about six years a decade ago to about 8 years now. In the UK, the average debt maturity is a whopping 15 years.

So what are the BIS and OBR talking about? They come up with different numbers by calculating an average maturity that includes reserve balances held by commercial banks at central banks. These reserve balances are generally compensated by central banks using their short-term policy rate and BIS and OBR are treating them as overnight debt when doing their average maturity calculations.

The BIS say about central bank asset purchases

Considering the consolidated public sector balance sheet, these operations retire long-term government debt from the market and replace it with overnight debt – interest bearing central bank reserves. Indeed, despite the general tendency for governments to issue at longer maturities, central bank purchases have shortened the effective maturity of public debt. Where central banks have used such purchases more extensively, some 15–45% of public debt in the large AE jurisdictions is in effect overnight.

Similarly, the OBR’s calculations show the median maturity of UK debt falls from 11 years to 4 years if you include reserve balances as an overnight liability. As an aside, I’m not sure median maturity is particularly interesting. If half my debt is due in 2 years, then that’s the median maturity. But it does matter whether the other half is due in 3 years or 100 years. I suspect median maturity has been chosen here for dramatic effect.

There are two reasons to worry about a shortening maturity for government debt. First, short maturities raise the probability of some kind of funding crisis. If the debt is all due relatively soon and investors decide not to roll over their funding, then there could be a debt crisis requiring a sovereign default and\or a large fiscal adjustment.

Second, and less dramatically, if the economy recovers and central banks raise interest rates, then the short-term debt will re-price at these higher interest rates and raise interest costs for the government.

Should we be worried? I don’t think so.

Rollover Concerns

I’ve always been uncomfortable with the labelling of central bank reserves as liabilities. Yes, in recent years, central banks have chosen to pay interest on them but they get to choose that interest rate and it can be zero if they want it to be. These are not debts that look like a normal person’s debts. But whatever about the labelling, I don’t think you can legitimately include central bank reserves in an average maturity calculation designed to measure potential debt rollover pressures.

These reserves are created by central banks to pay for asset purchases and there is nothing the banking system can do to get rid of them. An individual bank might be unhappy with having so much on reserve with the central bank but if they try to get rid of them by buying a security or extending a loan, their reserves just end up with another bank. As Ben Bernanke said, they’re like a hot potato.

Given this, there is no direct comparison between a sovereign bond maturing and an overnight reserve balance “maturing”. The owner of the maturing sovereign bond has to be paid and the money must be found from somewhere to pay it off – either the government’s existing cash balances or via new borrowing. In contrast, the banking system cannot demand that its reserves be “paid up.” In any case, the reserves already essentially are money and they can be turned into cash on demand.

So the risk of funding crises for most advanced economies is minimal and the real story of recent years is that governments around the world, but particularly in the UK, have locked in lots of very long-term low-interest debt.

Rising Interest Costs

This is, on the face of it, a more legitimate concern. Central banks used to raise interest rates by generating an artificial shortage of reserve balances, thus increasing the market interest rate paid to borrow these balances. In an age where reserves are in huge excess supply, this method doesn’t work anymore. Instead, central banks raise market interest rates by increasing the interest rate they pay on reserve balances to commercial banks and this rate then acts as a floor on market rates.

If central banks end up paying high interest rates on their reserve balances while holding a portfolio of long-term fixed rate bonds, then in theory, the central bank could start to make losses as interest paid exceeds interest earned. This could reduce their remittances back to central government and thus have fiscal effects. Taken to an extreme, there could be a scenario where there needs to be payments in the other direction because the central bank has so little money left it can’t fulfil its interest on reserves policy.

Thankfully, there is no need to worry about this stuff. Crucially, we know now that central banks can affect market interest rates without compensating all reserve balances. The Bank of Japan and the ECB operate a tiering system in which the interest rate on reserve balances is zero up until a bank’s reserves reach a certain level and then an interest rate is applied on those remaining balances. This keeps the marginal cost of funds in the economy at the policy rate while detaching the policy rate from the average cost of remunerating reserves. Currently, these central banks have a negative policy rate but tiering could be operated in future to raise interest rates without having much impact on the central bank’s profits.

Even if central banks decided to continue paying the policy rate on all reserve balances, there are reasons not to be too concerned. While reduced central bank profits during a monetary tightening are possible, outright losses are less likely. A 2015 Federal Reserve study simulated a sharp monetary tightening and concluded there may need to be a few years when the Fed reduced remittances to the Treasury to zero but the overall impact was relatively small. There are also other assets held by central banks that will provide an increased return as interest rates rise. For example, the interest payments on reserves created by the Eurosystem to make loans to banks are always more than offset by the higher interest payments charged on these loans.

So you could argue that technically neither the BIS or OBR are outright wrong about the maturity of “consolidated public liabilities” but there are good reasons to not be concerned about the points they raise. And claims about “ticking debt bombs” from the usual austerity cheerleaders should be taken with a massive dollop of salt.

Thoughts on Online Education

I see that many UK universities are announcing they are staying mainly online for 2021-22, with only small group teaching happening in person. I am not going to judge whether this is the right policy for the upcoming year because public health is not my area of expertise. However, Manchester University have announced that this is a permanent change and I suspect many others are considering this option.

Personally, I think making decisions now to permanently get rid of in-person lectures would be a mistake, both on the substance of the issue and on the timing and processes for making a decision of this sort. A few thoughts below.

Educational Substance

I have been teaching online since March 2020 and have worked hard at it. After a period recording lectures without anyone listening live, I settled on an approach of teaching online at the time of my scheduled timetabled slots and also recording the lecture. Despite my initial fears, I think this has worked reasonably well and feedback I received from students has generally been positive and kind.

The positive feedback for this format reflects both the live element and the recorded element. For some students, it is very important to be able to participate in their lectures in a structured timetabled way and also to be able to interact with a lecturer during a live session. My undergraduate classes have large class sizes and I will admit that I get more questions online – via the chat box – then I ever did when I taught live. Asking questions in front of many class mates is intimidating for most people but typing a question into a chat box is not – the question can also be sent just to the lecturer, giving the student complete privacy.

For other students, the access to recordings of the lectures is hugely positive. Students have told me it’s great that they can pause and rewind the lectures, particularly when they are covering something technical and how they can listen to lectures while they are on a walk, if it is less technical.

But there are important downsides to not having in-person lectures. In online lectures, students do not turn their cameras on and it is difficult to insist that they do. This means lecturers cannot see whether they are being understood. Manchester University have “pledged to continue in-person teaching for lectures with an “interactive” element, such as question and answer sessions.” But all live teaching is interactive. When my students are in front of me, I can see how they are responding to what I am saying. I can see how many look a bit puzzled, I can tell if they are smiling at my bad jokes or if they are paying attention to a bit that I signal is very important. Chat box questions are fine but they are not a substitute for a lecturer’s ability to “read the room”.

Another important interaction that is lost is the ability to come up in person after class to talk to a lecturer. I run online office hours and have been pleased with the number of students that have used them. Indeed, I plan to retain this option when in-person classes return. But students are more likely to use the online hours to go over a number of issues on the course rather than the traditional quick exchange after class to clarify what we have just discussed or to perhaps ask about something related to their degree or something that is tangentially related to the course material.

Finally, it is important for students to be learning around other students and to have the time and space to talk about what they are learning after lectures. Universities can try to encourage online study groups but there is no good substitute for meeting the other people on your course and talking with them about how they are getting on.

For these reasons, I strongly hope that my university returns to in-person lectures as soon as it is safe to do so. Based on communications from our President, I fully expect this to happen.

Are there things that we have learned from teaching online? Yes. When I return to live teaching, I plan to record the lectures. Currently, I’m thinking of teaching live both in-person and on Zoom using a laptop brought to lectures. This would allow students to either attend in person or listen live at home or listen to a recording. Students that attend live could still use a chat box via phone or laptop to ask questions. This retains the advantages of online teaching while bringing back the benefits of live teaching.

Some lecturers will be uncomfortable with this approach because of the technology demands it places on them (I’m pretty good with tech but I don’t know if I can actually pull it off). Others will argue that learning in person is the “gold standard” and making lectures available online will reduce class attendance and damage educational standards.

I’m not so sure. My courses are popular but attendance at lectures has always been pretty spotty. Whether lecturers like it or not, students are not always in a position to attend every lecture, whether it be because they get sick, or have to work a part-time job to support themselves or perhaps have a long commute because housing costs in their university’s location are prohibitively expensive. Making recordings available would benefit these students but it can also benefit the students who actually attended class. When students are revising for exams or writing an assignment and think “what did the lecturer say about that in class again?” with recordings they can go back and listen.

I have also switched to having weekly online MCQ quizzes to replace an MCQ midterm exam and I have decided to keep this since it seemed to work better at keeping students engaged and the feedback I received from students was also positive.

So we have much to benefit from by using technology but that doesn’t mean we should scrap in-person lectures.

A Difficult Sell

You can see from the above that I am not wholly negative about online teaching and my experience is that for some students, the positive have actually outweighed the negatives. But universities need to understand that the majority of students want to at least have the option to attend lectures in person and that going into college to learn and meet other students is a crucial part of the university experience.

And as can seen from the initial response to Manchester’s announcement, students and their parents will respond to the removal of in-person lecturers with the demand to reduce fees: If you provide us with an inferior service, then we’re not willing to pay you as much. This puts universities in a difficult situation because it is not cheaper to deliver online education than in-person teaching. You still need to pay the lecturers and they actually spend more time on things like recording lectures or designing new assessments that work online than they did in the past when you could just show up to teach in person and set an exam to be taken in an exam hall. Expenditures on tech support and cloud storage also likely go up.

Longer term, there may be savings from having fewer staff and students on campus but for now those cost savings are likely to be small. Moreover, any move to downgrade the importance of in-person teaching in UK universities would be ironic since the additional income that came with the £9,000 annual fees and the race for high fees from international students had lead to a boom in capital spending on campuses as universities competed with each other on the basis of the quality of on-campus life as well as educational quality. De-emphasising the campus experience will be a very difficult sell.

Timing and Process

The issues around how to combine technologies and in-person teaching are complex and there are many lessons to take from our recent experiences. I have listed some above but I’m sure there are lots of aspects that I haven’t considered or that affect subjects that I don’t teach.

To my mind, now is not the time for universities to be taking decisions to permanently change their approach to teaching. Universities should instead instigate processes of consulting with staff and students about what they like and dislike about the online approach and then focus on how much of the good new stuff we can keep while retaining as much of the good old stuff as we can. Where trade-offs emerge, they should be carefully weighed up. If this process takes a few years, then so be it.

There is also a deeper issue. Students that have signed up for a degree based on in-person lectures should not be told in the middle of this degree that those lectures are being discontinued. How many would have chosen to attend the university if they had known the experience was going to be radically different from what was advertised? Purely on the grounds of fairness and avoidance of reputational damage, I would recommend that any university considering this move should wait until the graduation of the final student cohort that was advertised a degree with in-person lectures.

Presentation on “Do Central Banks Control the Price Level?”

A few weeks ago, I was invited to speak on “Do Central Banks Control the Price Level?” by the Forum for Macroeconomics and Macroeconomic Policies (FMM) at their annual conference. The panel also included Frances Coppola and Scott Fullwiler.

My presentation is here and you can find video of the session here. I went last, starting at 56 minutes.

Presentation on ECB: Monetary Financing, Helicopter Money etc.

PublicPolicy.ie held its second online conference today on “Ireland’s COVID19 Crisis Response: Perspectives from Social Science.” I gave a talk on a panel titled “EU Dimensions of a Policy Response”. I mainly discussed the role of the ECB, covering some of more extreme potential measures it could take. I discuss monetary financing, helicopter money and the idea of the Eurosystem selling all its gold and returning the money to governments.